Accounts receivables can be one of your largest assets and whether your customer has formally filed for bankruptcy or is significantly delaying payment, the effects on your cash flow and balance sheet can be severe. Trade Credit Insurance provides an additional line of defense for your balance sheet and ensures you get paid for the goods and services you supply.

Trade Credit

Our Trade Credit products have been designed to mitigate the risks of non-payment and to provide specialty coverage wherever our clients are positioned in the supply chain. All of our policies are assigned a dedicated underwriter and are backed by our online policy management system.

To learn more, please contact Alexandre Blais at 613-748-7344 x 48000

Resources

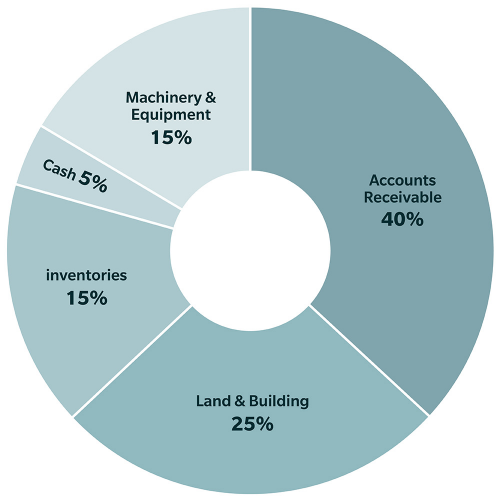

Insured assets on the balance sheet

Trade credit insurance provides additional asset protection

- Machinery and Equipment are insured

- Land and Building are insured

- Inventories are insured

Accounts receivable should be insured since it can constitute 40% or more of a company's assets